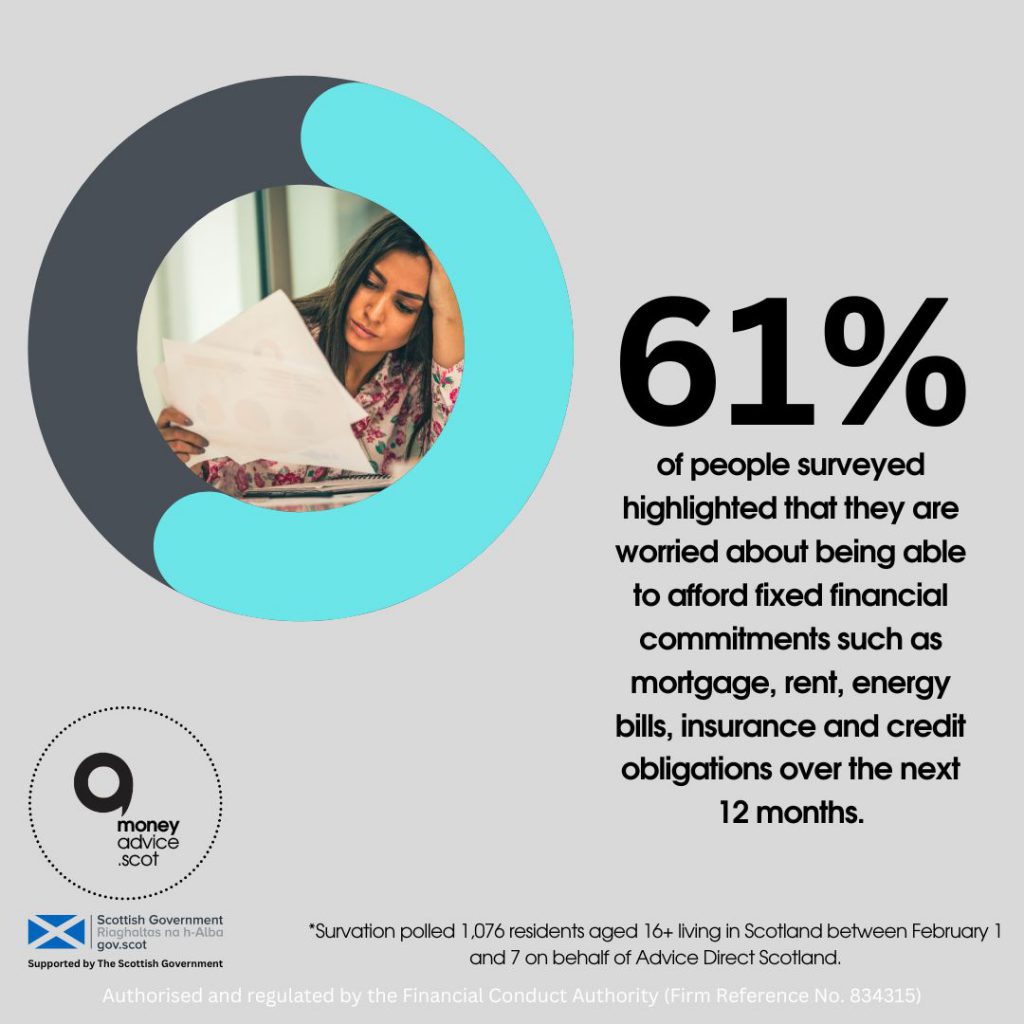

A new poll has found that six-in-ten Scots are worried about affording their bills this year including mortgage repayments, monthly rent, and energy costs.

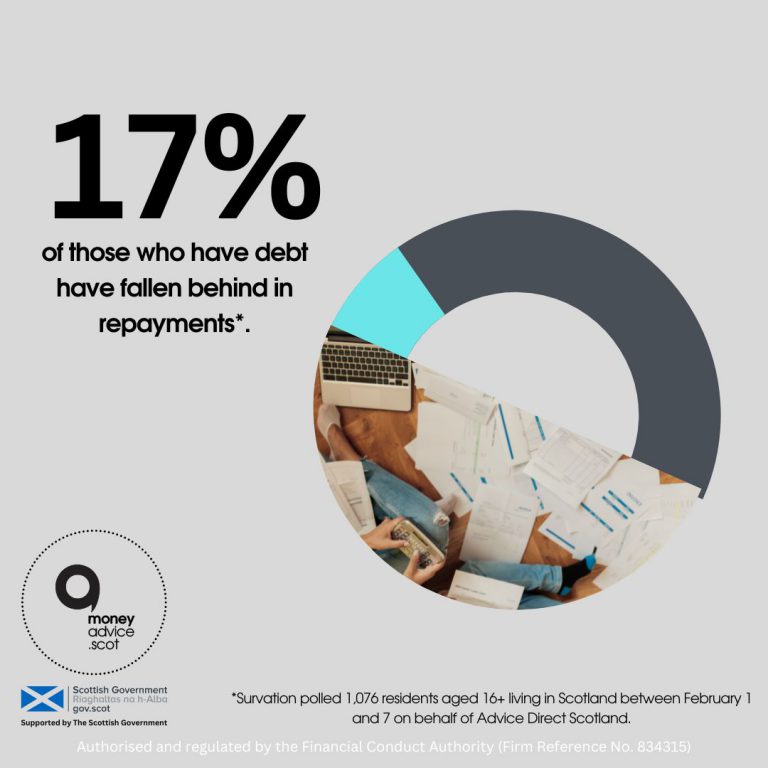

The Survation poll commissioned for Advice Direct Scotland, also revealed that 17% of those with debt have fallen behind in their repayments. Survation polled 1,076 residents aged 16+ living in Scotland between the 1st and 7th of February.

Types of Debt

Energy bills, credit cards, and council tax arrears were selected as the most common forms of debt for those in this situation. Among those in debt, a quarter said they owed £10,000 or more, while nearly a third of those with a credit card said they have used it more to pay for everyday costs.

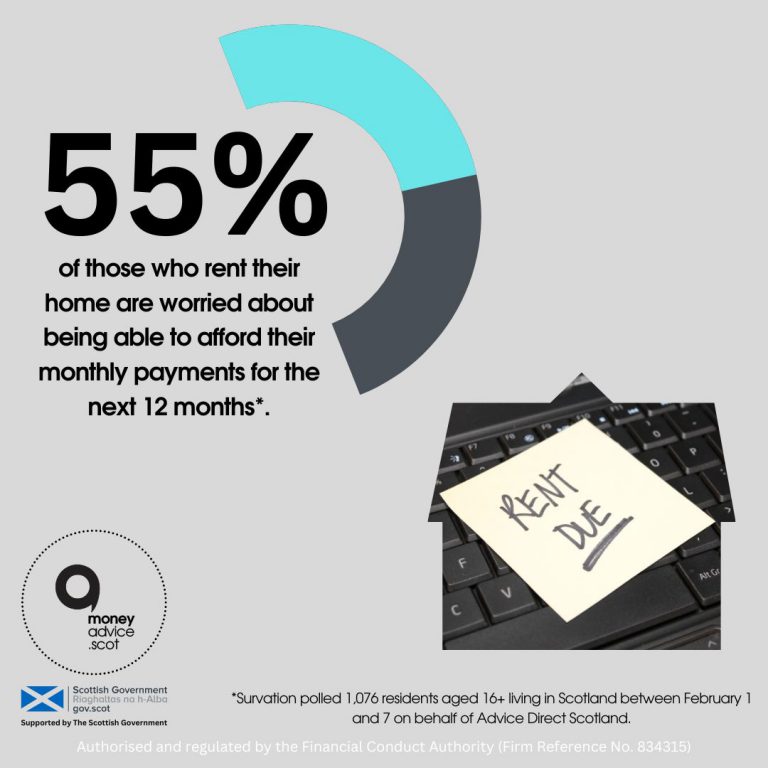

The poll also found concerns among Scots about housing costs, with 47% of those with a mortgage worried about being able to afford monthly payments, and 55% of those who rent their home expressing the same concern.

Mortgage Fixed Rate Deals

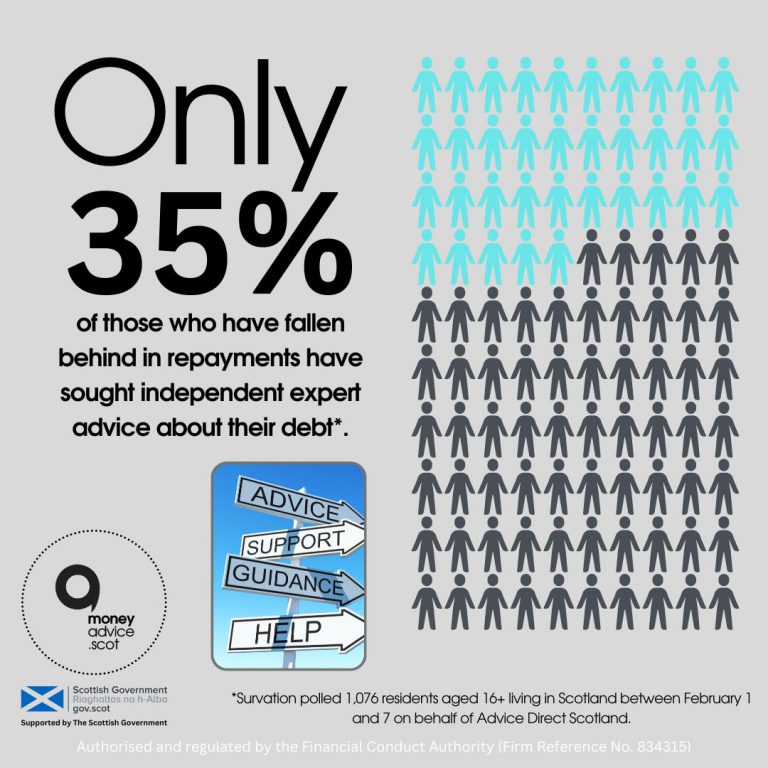

Around a fifth (21%) of those with a mortgage said they are on a fixed-rate deal which ends in the next 12 months, in a sign of the challenges ahead amid rising interest rates. However, the poll shows that 63% of those who have fallen behind on repayments have not sought independent expert advice about their debt.

The findings come as Advice Direct Scotland launch our new campaign across social media and in newspapers to promote our free independent debt advice service, moneyadvice.scot, which is authorised and regulated by the Financial Conduct Authority and is supported by the Scottish Government.

Our specialist debt and money advisers can work with people to assess their current situation, look at their income and outgoings, and consider what to do next. This includes assessing that people are receiving all the benefits they are entitled to. Our free service can be contacted by visiting www.moneyadvice.scot or on 0808 196 2316 (Monday to Friday, 9am-5pm).

Key poll findings:

-

- 61% are worried about being able to afford fixed financial commitments such as mortgage, rent, energy bills, insurance and credit obligations over the next 12 months.

-

- 17% of those who have debt have fallen behind in repayments.

-

- 42% of those with debt said it has increased over the past 12 months.

-

- 29% of those with a credit card have used it more to pay for everyday costs over the past 12 months.

-

- 47% of those with a mortgage are worried about being able to afford their monthly payments for the next 12 months.

-

- 55% of those who rent their home are worried about being able to afford their monthly payments for the next 12 months.

-

- Only 35% of those who have fallen behind in repayments have sought independent expert advice about their debt.

moneyadvice.scot provide free information and support on a wide-range of debt-related issues. Our specialist debt advisers can work with you to assess your current situation, look at your income and expenditure and decide what to do next. You can call the team on 0808 196 2316 (Monday to Friday, 9am-5pm).

By reaching out for advice and support, or just having a conversation about our current situation, we can put ourselves back on track and take away some of the worry.